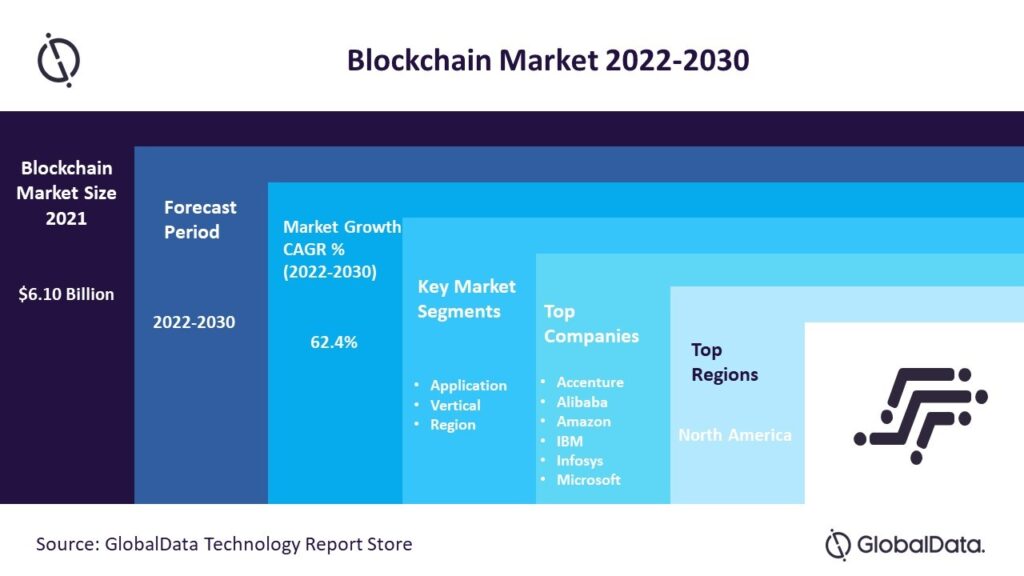

The latest publication titled Blockchain Market Size, Share, Trends, Analysis Report 2021-2030 has been added to the report store by GlobalData Plc. The report estimates the blockchain market size was valued at USD 6.10 billion in 2021. Major blockchain market drivers including the rising popularity of Blockchain as a Service and growing acceptance of cryptocurrency will promote the blockchain market growth during the next few years. Furthermore, the increased spending in blockchain from the financial sector to promote cost & time savings coupled with the surge in adoption of blockchain in the retail sector will further propel the market growth in the long run.

Read Sample Report PDF for more market drivers.

However, the blockchain market growth may witness hindrances due to factors including the lack of blockchain talent and lack of regulatory clarity. The nascent nature and complexity of blockchain mean that a lack of skilled talent presents a barrier to executing initiatives. It has also contributed to the strong demand for BaaS. Furthermore, for blockchain to become commercial, it must be seen as a trustworthy technology. Trust requires clear communication and robust implementation of rules governing data privacy and security. Most enterprises work with privacy rules governed by regulation, with consumers trusting them with sensitive information. However, with public blockchains, the data will not be private anymore.

Request for Sample Report for More Insights on the Key Market Challenges

Blockchain Market Segment Highlights

- By Application

- Supply Chain Management: As of 2021, supply chain management and cross-border payments were the most prominent application markets. Many of the leading players in the logistics sector, including FedEx and UPS, are investing in blockchain. With blockchain, companies can trace products through supply chains to flag potentially damaging in-transit events, such as signs of tampering, extreme environmental conditions, or careless handling.

- Cross-border Payments & Settlements

- Lot Lineage/Provenance

- Trade Finance & Post-trade Settlements

- Identity Management

- Others

- By Vertical

- BFSI: BFSI vertical held the largest blockchain market share in 2021. Companies such as IBM, Digital Asset Management, and Ripple are working via open-source DLT platforms such as Ethereum and Hyperledger to develop use cases and applications for innovative banks –notably Goldman Sachs, Citi, Santander, and Ping An –and for stock exchanges ranging from the LSE to the ASX. At the same time, at least half a dozen central banks are in the fray for introducing digital fiat currency notes, with a marked potential impact on interbank settlements and government bond dealing.

- Transport and Logistics

- Cross-sector

- Retail

- Healthcare

- Government

- Regional Opportunities

- North America: North America, particularly the US, remains the dominant region in developing blockchain technologies, accounting for 41% of blockchain revenues in 2021, according to GlobalData forecasts. The US is the home of most blockchain-related M&A deals, venture financing, and patents. Early adoption of blockchain and the presence of major players like IBM, Microsoft, and Amazon have given the US a competitive advantage. In addition, governments in North America focus on investing in blockchain solutions for use in the public sector. For example, the US Food and Drug Administration launched a pilot project in 2020 exploring using blockchain to track and verify prescription drugs.

- Asia-Pacific

- Europe

- Middle East & Africa

- South & Central America

Grab your Sample Report Copy for Segment-wise Insights and Regional Opportunities

Blockchain Market Vendor Landscape

This industry is highly fragmented. However, with the growth of start-ups and new venture launches the competition is gradually intensifying. Key players in this market include Accenture, Alibaba, Amazon, IBM, Infosys, Microsoft, Oracle, Salesforce, Tencent, Wipro, Ping An Insurance, and JPMorgan Chase & Co., among others.

Top Blockchain Companies Include:

- Accenture: The company has released several solutions that support use cases focused on its key focus areas including supply chain, digital identity, and financial services. The company has partnered with Finland’s State Treasury to develop a prototype for managing vehicle identity and insurance using blockchain.

- Alibaba: The company is a provider of e-commerce and technology infrastructure services. In August 2021, Alibaba Group opened a new online market for digital assets traded over a blockchain, backed by the Sichuan provincial government.

- Amazon: The company is an online retailer and web service, provider. In September 2022, the company launched Amazon Managed Blockchain (AMB) allowing customers in both the public and commercial sectors to create and manage production-grade blockchain infrastructure with just a few clicks.

- Affirm Inc

- IBM

- Infosys

- Microsoft

- Oracle

- Salesforce

- Tencent

- Wipro

- Ping An Insurance

- JPMorgan Chase & Co.

For more vendor-specific insights, Download Sample PDF

About GlobalData

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights.

Media Contacts

Mark Jephcott

Head of PR EMEA

+44 (0)207 936 6400