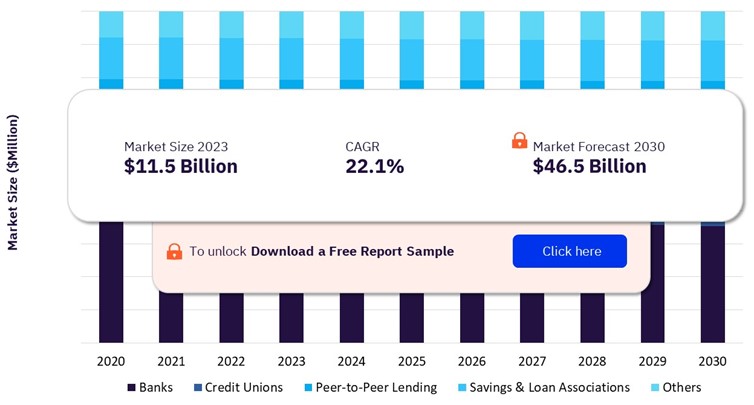

The global digital lending platforms market size will reach $11.5 billion in 2023, according to a new report by GlobalData Plc. The market will be driven by the growing digitalization in the banking and finance sector which are generating new opportunities for digital lending platforms. According to the Global Findex Index from the World Bank, in developing economies, the share of adults who make or receive digital payments grew from 35% in 2014 to 57% in 2021.

Digital Lending Platforms Market by End Use, 2020 – 2030

Digital Lending Platforms market outlook report with detailed segment analysis is available with GlobalData Now! Download a FREE sample!

Digital Lending Platforms Market FAQs

The Digital Lending Platforms market size globally will be valued at $11.5 billion in 2023.

The global Digital Lending Platforms market is expected to grow at a CAGR of 22.1% over the forecast period (2023-2030).

The increased demand for digital channels, faster loan approvals and disbursements, and integration of emerging technologies in the lending platforms are some of the major factors driving the market growth.

o Type: Software, Services

o Deployment: Cloud, On-premise

o End Use: Banks, Credit Unions, Peer-to-Peer Lending, Savings & Loan Associations, Others

The leading Digital Lending Platforms companies are EdgeVerve Systems Limited, Fidelity National Information Services Inc. (FIS), Finastra Group Holdings Ltd, LendingTree, LLC, Roostify Inc., BlendLabs Inc., Newgen Software Technologies Limited, Nucleus Software Exports Ltd., One97 Communications Ltd, and Wipro Limited.

Got more queries? Have all your questions answered in this PDF sample

Digital Lending Platforms Market Dynamics

The COVID-19 pandemic has positively impacted the use of digital lending platforms, as traditional banking services faced limitations due to lockdowns and social distancing measures. People turned to online platforms for their financial needs. Digital lending platforms provide a convenient and accessible way for individuals and businesses to access loans and credit remotely. Moreover, the growing significance of open banking is generating new prospects for market growth globally. Open banking facilitates the lenders to effectively put together the borrowers’ data, such as credit scoring, current outstanding debts, and previous loans, among others. This assists the lenders in accelerating their decision processes and providing tailored lending solutions to the clients based on their needs.

Learn about the digital lending platforms market dynamics by viewing report sample right here!

Digital Lending Platforms Market Report Highlights

Unlock additional market dynamics impacting the digital lending platforms market growth by requesting a sample PDF.

GlobalData Plc has segmented the Digital Lending Platforms market report by type, software, deployment, end-use, and region:

Digital Lending Platforms Market – Revenue Opportunity Forecast, by Type, 2020-2030 ($M)

Digital Lending Platforms Market – Revenue Opportunity Forecast, by Deployment, 2020-2030 ($M)

Digital Lending Platforms Market – Revenue Opportunity Forecast, by End Use, 2020-2030 ($M)

Digital Lending Platforms Regional Outlook (Revenue, $M, 2020-2030)

Know segment-wise insights as you grab your sample report copy

Related Reports

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

GlobalData Mark Jephcott Head of PR EMEA mark.jephcott@globaldata.com cc: pr@globaldata.com +44 (0)207 936 6400

Tags:

Reportedtimes, iCN Internal Distribution, Extended Distribution, Research Newswire, English